What is NRR?

NRR, short for Net Revenue Retention, measures the percentage of recurring revenue retained from existing customers over a specific period, including the impact of expansions (upsells, cross-sells) and reductions (churn, downgrades). NRR provides a comprehensive view of how your existing customer base is growing or shrinking, making it a key metric for SaaS companies focused on sustainable growth.

How to calculate Net Revenue Retention (NRR).

How to calculate Net Revenue Retention (NRR).

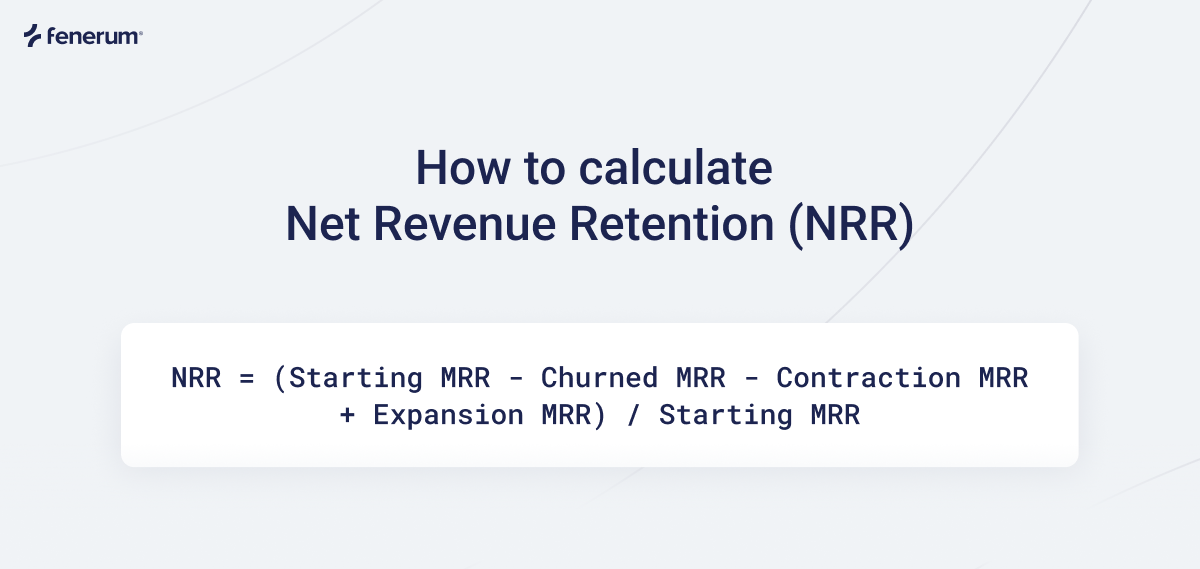

How to calculate NRR

Tracking NRR helps businesses understand not just how much revenue they retain, but also how much they expand within their existing customer base. For SaaS companies, NRR is a critical metric for evaluating customer retention, expansion, and overall revenue health.

The formula for NRR is:

NRR = (Starting MRR - Churned MRR - Contraction MRR + Expansion MRR) / Starting MRRWhere:

- Starting MRR: Monthly Recurring Revenue from existing customers at the beginning of the period.

- Churned MRR: Revenue lost from customers who canceled their subscriptions.

- Contraction MRR: Revenue lost from customers who downgraded their subscriptions.

- Expansion MRR: Revenue gained from existing customers through upsells, cross-sells, or reactivations.

For example, if a company starts the month with $10,000 in MRR, loses $500 to churn, $200 to downgrades, but gains $1,000 from expansions, the NRR calculation would be:

NRR = ($10,000 - $500 - $200 + $1,000) / $10,000 = $10,300 / $10,000 = 103%NRR meaning in SaaS

For SaaS businesses, NRR is a powerful indicator of growth within the existing customer base. An NRR above 100% means that expansions and upsells more than offset any losses from churn and downgrades, signaling strong product-market fit and customer satisfaction. NRR is often used by investors and operators to assess the long-term viability and growth potential of a SaaS business.

Key points about NRR in SaaS:

- Includes: Expansions, upsells, and reactivations from existing customers.

- Accounts for: Churn and downgrades.

- Can exceed 100%: If expansion revenue outpaces losses.

NRR is often compared to Gross Revenue Retention (GRR):

- NRR: Includes expansions and upsells, can exceed 100%.

- GRR: Excludes expansions and upsells, always capped at 100%.

NRR Benchmarks

Industry benchmarks for Net Revenue Retention (NRR) can vary depending on company size, market segment, and business model. However, here are some general guidelines for SaaS companies:

- NRR below 100%: Indicates the company is losing more revenue from churn and downgrades than it is gaining from expansions. This is a warning sign and suggests a need to improve retention or upsell strategies.

- NRR of 100%: The company is retaining all recurring revenue from existing customers, with expansions offsetting churn and downgrades.

- NRR of 110%–120%: Considered strong for most SaaS businesses. This means the company is growing revenue from its existing customer base, even before acquiring new customers.

- NRR above 120%: World-class performance, often seen in top-performing SaaS companies targeting enterprise customers. This level of NRR indicates exceptional product-market fit and effective expansion strategies.

Note: Benchmarks can differ by industry and customer segment. For example, enterprise-focused SaaS companies often report higher NRR than those serving SMBs.

Conclusion

Understanding NRR and its importance is essential for SaaS business growth. Net Revenue Retention reflects a company's ability not only to retain but also to expand revenue from its existing customers. By focusing on customer success, driving product adoption, and identifying upsell opportunities, companies can maximize their NRR and accelerate long-term growth.

To make tracking and improving NRR easier, consider automating the calculation process. Book a demo of Fenerum