What is Burn Rate?

Burn rate is a financial metric that measures how quickly a company is spending its available cash, typically expressed on a monthly basis. For SaaS and startup businesses, burn rate is a critical indicator of how long the company can operate before needing additional funding. It helps founders, investors, and finance teams understand the company's cash runway and make informed decisions about growth, spending, and fundraising.

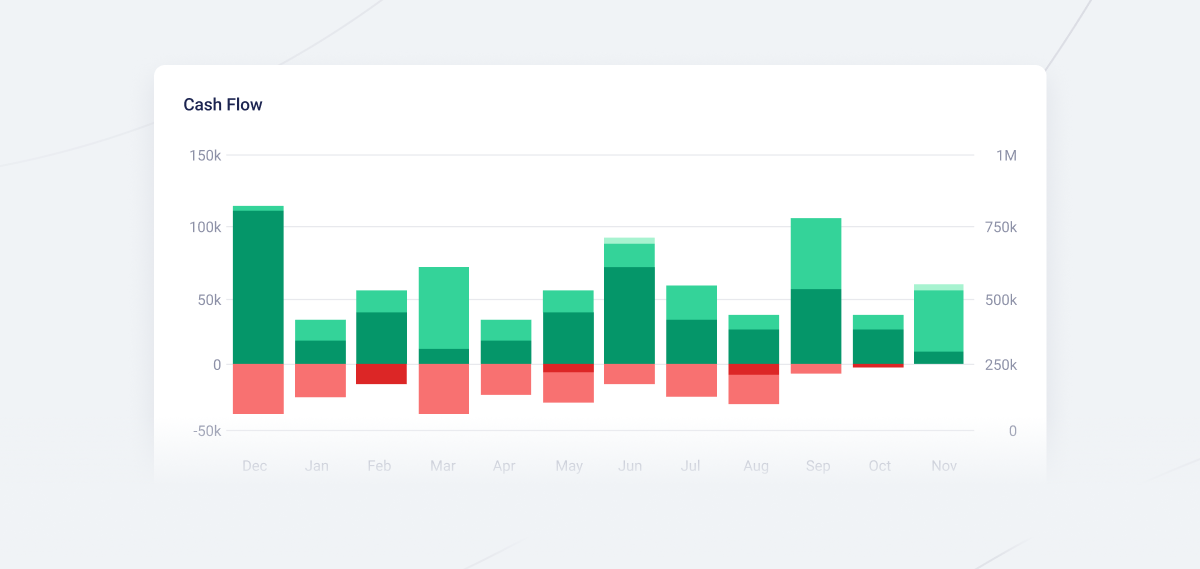

Burn rate chart example. A visual representation of cash outflow over time.

Burn rate chart example. A visual representation of cash outflow over time.

How to Calculate Burn Rate

Knowing how to calculate burn rate is essential for managing your company's finances. There are two main types of burn rate:

- Gross Burn Rate: The total amount of cash spent per month (operating expenses only).

- Net Burn Rate: The net amount of cash lost per month (operating expenses minus revenue).

The most common burn rate formula is:

Burn Rate = (Starting Cash - Ending Cash) / Number of MonthsFor example, if your company starts the quarter with $300,000 in cash and ends with $240,000 after three months, the monthly burn rate calculation would be:

Burn Rate = ($300,000 - $240,000) / 3 = $20,000 per monthCash burn rate formula:

Cash Burn Rate = Cash Spent per MonthNet burn rate formula:

Net Burn Rate = (Cash Spent per Month) - (Cash Received per Month)Burn Rate Meaning in SaaS

For SaaS companies, burn rate is a vital metric for understanding how quickly the business is using up its cash reserves. A high burn rate can signal aggressive growth or overspending, while a low burn rate may indicate efficient operations or slower growth. Monitoring burn rate helps SaaS founders and finance teams:

- Assess how long the company can operate before needing new funding (runway)

- Make strategic decisions about hiring, marketing, and product development

- Communicate financial health to investors and stakeholders

Burn Rate Benchmarks

Burn rate benchmarks vary by industry, stage, and business model. However, here are some general guidelines for SaaS startups:

- Early-stage startups: Often have higher burn rates as they invest in growth, product development, and customer acquisition.

- Growth-stage companies: May maintain a moderate burn rate while scaling operations and revenue.

- Mature SaaS businesses: Typically aim for a lower burn rate and positive cash flow.

A common rule of thumb is to maintain at least 12–18 months of runway. If your burn rate is $50,000 per month and you have $600,000 in the bank, your runway is 12 months.

Note: Burn rate should be evaluated alongside other metrics like Monthly Recurring Revenue (MRR), Churn Rate, and Customer Acquisition Cost (CAC) for a complete financial picture.

Why Burn Rate Matters

Understanding and managing your burn rate is essential for SaaS growth and survival. A sustainable burn rate allows you to:

- Plan for future fundraising rounds

- Avoid running out of cash unexpectedly

- Make data-driven decisions about spending and growth

- Build trust with investors by demonstrating financial discipline

Conclusion

Burn rate is a crucial metric for SaaS companies and startups. By tracking your cash burn rate, understanding the burn rate formula, and monitoring your runway, you can make smarter financial decisions and set your business up for long-term success.

To make tracking and improving your burn rate easier, consider automating your financial reporting. Book a demo of Fenerum