What is GRR?

GRR, short for Gross Revenue Retention, refers to the percentage of recurring revenue a company retains from its existing customers over a specific period, excluding any revenue gained from expansions, upsells, or cross-sells. GRR focuses only on revenue lost due to customer churn and downgrades, providing a clear picture of how well a company retains its core revenue base.

How to calculate Gross Revenue Retention (GRR).

How to calculate Gross Revenue Retention (GRR).

How to calculate GRR

Calculating and tracking GRR helps businesses understand the health and predictability of their recurring revenue. For SaaS companies, GRR is a key metric for evaluating customer retention and revenue stability.

Calculating GRR is straightforward if you have the right data.

GRR = (Starting MRR - Churned MRR - Contraction MRR) / Starting MRRWhere:

- Starting MRR: Monthly Recurring Revenue from existing customers at the beginning of the period.

- Churned MRR: Revenue lost from customers who canceled their subscriptions.

- Contraction MRR: Revenue lost from customers who downgraded their subscriptions.

For example, if a company starts the month with $10,000 in MRR, loses $500 to churn, and $200 to downgrades, the GRR calculation would be:

GRR = ($10,000 - $500 - $200) / $10,000 = $9,300 / $10,000 = 93%GRR meaning in SaaS

For SaaS businesses, GRR is a fundamental metric because it measures the stability and health of the existing revenue base. High GRR indicates that a company is effective at retaining its customers and minimizing revenue loss from downgrades and churn. This predictability is essential for long-term planning, budgeting, and forecasting.

Key points about GRR in SaaS:

- Churned MRR: Revenue lost from customers who cancel.

- Contraction MRR: Revenue lost from customers who downgrade.

- Excludes: Any revenue gained from expansions, upsells, or reactivations.

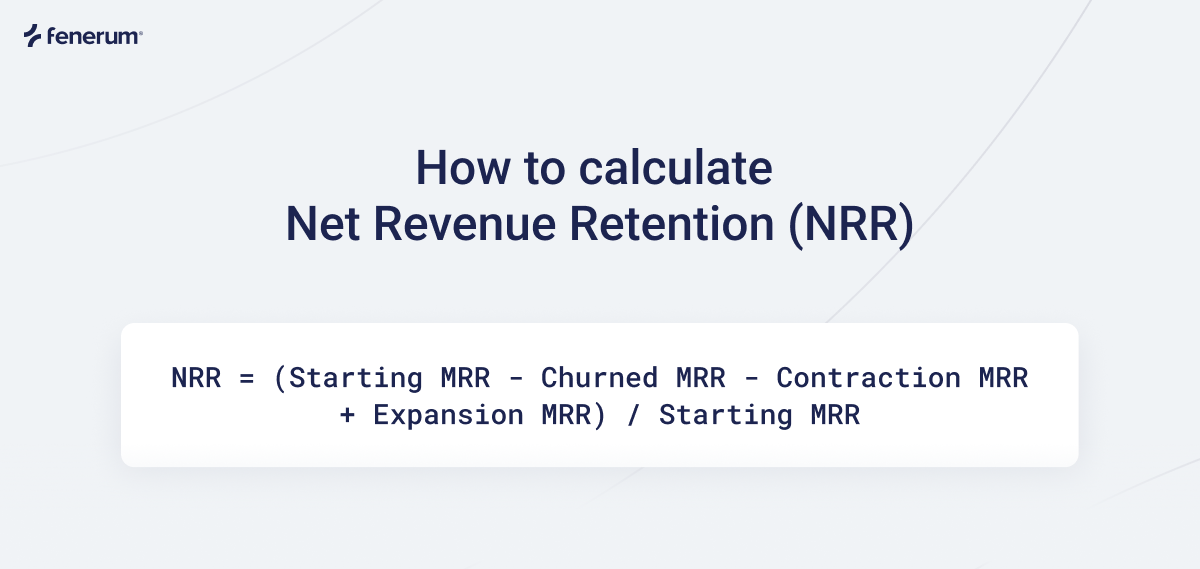

GRR is often compared to Net Revenue Retention (NRR):

- GRR: Excludes expansions and upsells, always capped at 100%.

- NRR: Includes expansions and upsells, can exceed 100% if expansions outpace churn.

GRR Benchmarks

Gross Revenue Retention (GRR) benchmarks also vary by company size and market, but here are some typical ranges for SaaS companies:

- GRR below 90%: Indicates significant revenue loss from churn and downgrades. This is a red flag and suggests a need to address customer retention.

- GRR of 90%–95%: Common for many SaaS businesses, especially those serving SMBs. Indicates moderate churn but generally healthy retention.

- GRR of 95%–99%: Strong performance, often seen in mature or enterprise-focused SaaS companies. Reflects effective customer success and retention strategies.

- GRR of 99%–100%: Exceptional retention, rare even among top SaaS companies. Indicates minimal churn and downgrades.

Note: Unlike NRR, GRR cannot exceed 100% since it excludes expansion revenue. Benchmarks may differ by industry and customer type.

Conclusion

Understanding GRR and its importance is essential for SaaS business growth. Gross Revenue Retention reflects a company's ability to retain its core recurring revenue. By focusing on customer satisfaction, addressing churn, and continuously improving the product, companies can maximize their GRR and ensure long-term growth and stability.

To make tracking and improving GRR easier, consider automating the calculation process. Book a demo of Fenerum