What is Cash Flow?

In short, cash flow refers to the movement of money in and out of a business over a specific period. Cash flow helps to determine the liquidity and financial health of the organization. Positive cash flow means that more money is coming into the business than going out, which is crucial for covering salaries, rent, debt repayments etc. Negative cash flow indicates that a company may struggle to meet its financial obligations, which could indicate potential issues.

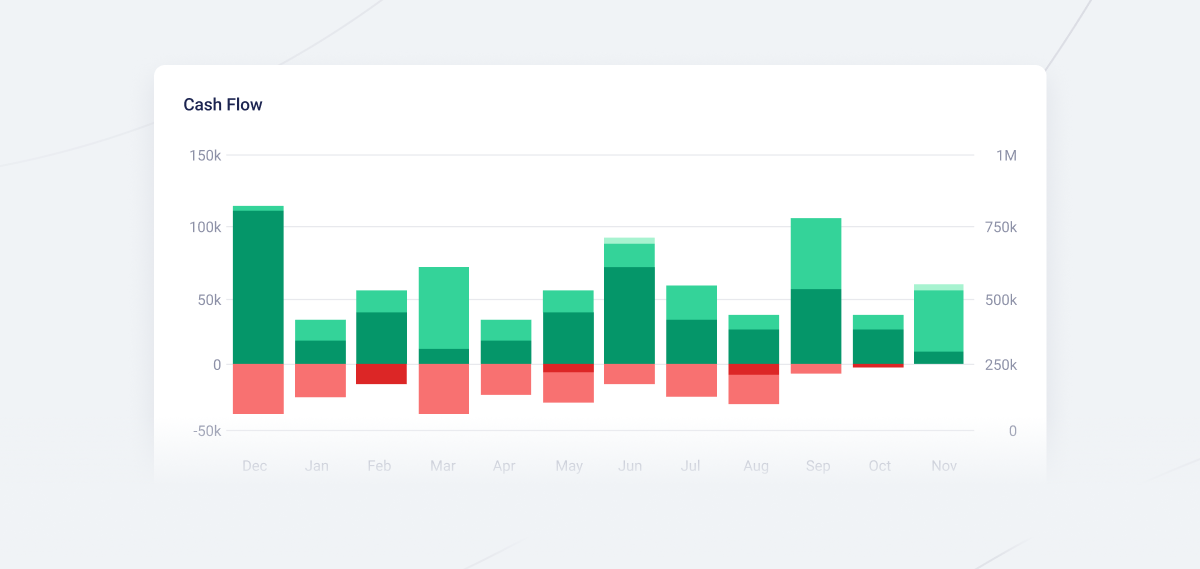

Fenerum dashboard showing cash flow chart.

Fenerum dashboard showing cash flow chart.

Maintaining positive cash flow is essential for sustaining operations and supporting growth. Proper cash flow management is a no-brainer, and it ensures that a business can meet their obligations, invest in growth, and avoid potential financial issues. To sum up cash flow can be broken down into two main components: incoming cash flow and outgoing cash flow.

Incoming cash flow

Incoming cash flow refers to all the money that flows into the business, primarily from sales, financing and returns on investments. If the incoming cash flow is greater than the outgoing cash flow, the company has a positive cash flow. This means that the company is earning more money than it is spending, which is a healthy sign for the business.

Outgoing cash flow

Outgoing cash flow on the other hand, is the money that leaves the business. This includes expenses such as salaries, rent and loan repayments. If the company's outgoing cash flow is greater than the incoming cash flow, the company has a negative cash flow. This indicates that more money is leaving the business than coming in. For example, it is quite common for a SaaS company and start-ups to have a negative cash flow during its startup phase.

Free Cash Flow Definition

An important term relating to cashflow is 'Free Cash Flow (FCF)'. The free cash flow definition is: The cash a company generates after accounting for operating expenses and capital expenditures, such as new equipment or property. It represents the cash available to the company to repay creditors, pay dividends, or reinvest in the business.

The free cash flow emphasizes the importance of liquidity beyond operating profits. While a company might be profitable on paper, negative free cash flow could indicate insufficient funds to sustain operations or growth. Investors often consider free cash flow as a reliable indicator of a company's ability to generate long-term value. This makes free cash flow even more important as it could play a big role if you are out searching for investors.

Discounted Cash Flow Models

This leads us to another relevant term: 'Discounted cash flow model (DCF)'. The discounted cash flow model is an advanced method used to estimate the value of an investment based on its expected future cash flows. By applying the cash flow discount model, businesses discount future cash flows to their present value using a discount rate that reflects the investment's risk level.

This model is widely used in finance for investment decision-making. It helps investors and business owners assess whether an investment is worth pursuing. The principle behind the DCF model is simple: a dollar earned in the future is worth less than a dollar earned today. Discounted cash flow models are particularly useful for valuing companies, real estate, and other long-term investments.

Cash Flow Forecasting and Analysis

'Cash flow forecasting' and 'cash flow analysis' are critical tools for maintaining a business's financial health. Both processes help companies understand their current liquidity while preparing for future cash needs, offering a comprehensive view of their financial situation.

Cash Flow Forecasting

Cash flow forecasting uses historical cash flow data to predict future cash movements. This projection enables businesses to anticipate cash shortages or surpluses and adjust their operations accordingly. Accurate forecasting is crucial for long-term planning and avoiding financial difficulties, especially during uncertain periods.

Cash Flow Analysis

Cash flow analysis on the other hand, involves examining past and present cash inflows and outflows to assess the company's liquidity and operational efficiency. By identifying patterns and trends in cash flow movement, businesses can spot inefficiencies, determine their capacity to cover expenses, and make informed decisions about reinvestment or debt management.

Cash Flow in SaaS Businesses

For SaaS companies, managing cash flow presents unique challenges and opportunities. SaaS businesses often operate on a subscription model, meaning they receive regular, Monthly Recurring Revenue from customers. This model can lead to a more predictable incoming cash flow compared to traditional businesses, which may experience more variability.

However, SaaS companies often invest heavily in customer acquisition and product development upfront, which can strain cash flow. To manage this, SaaS businesses must focus on optimizing their cash flow by carefully managing expenses, pricing strategies, and ensure a low Churn Rate. Additionally, cash flow forecasting is particularly critical in SaaS, as it allows businesses to plan for growth and ensure they have the necessary resources to scale.

Avoid Cash Flow Excel Templates

While cash flow Excel templates are commonly used for tracking cash flow, they come with limitations that can hinder a business’s financial efficiency as it grows. Though Excel is useful for simple financial tracking, relying on spreadsheets can lead to errors, time-consuming updates, and a lack of real-time visibility. Here’s why a dedicated tool for cash flow management is a better choice:

- Reduce human error: Manual entry in Excel increases the risk of mistakes such as miscalculations or incorrect data input. Even small errors can lead to inaccurate cash flow forecasts, which may cause poor financial decisions.

- Get real-time insights: Excel is not built for real-time data tracking. A dedicated cash flow management tool connects directly to your business's financial data, offering real-time and accurate updates.

- Advanced forecasting abilities: While Excel requires manual forecasting, a cash flow tool can generate cash flow forecasting models based on historical data with minimal input.

For example a tool like Fenerum helps subscription businesses get automatic and real-time cash flow management. This enables advanced forcasting, so you can make decisions based on numbers you can trust.

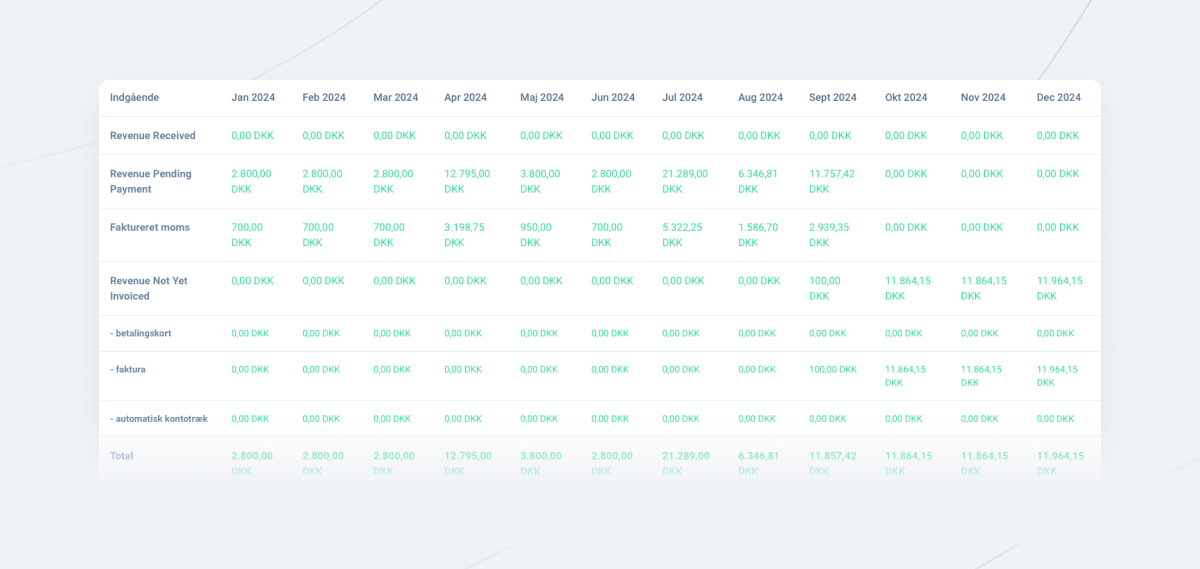

Fenerum table showing cash flow.

Fenerum table showing cash flow.

Conclusion

Effective cash flow management is fundamental to business success. Whether through cash flow analysis, using tools like the cash flow discount model, or employing cash flow forecasting techniques, staying on top of your company’s cash movements is critical. Businesses that can maintain strong free cash flow are in a better position to seize new opportunities and withstand financial challenges.