Nykredit

Overview of the integration

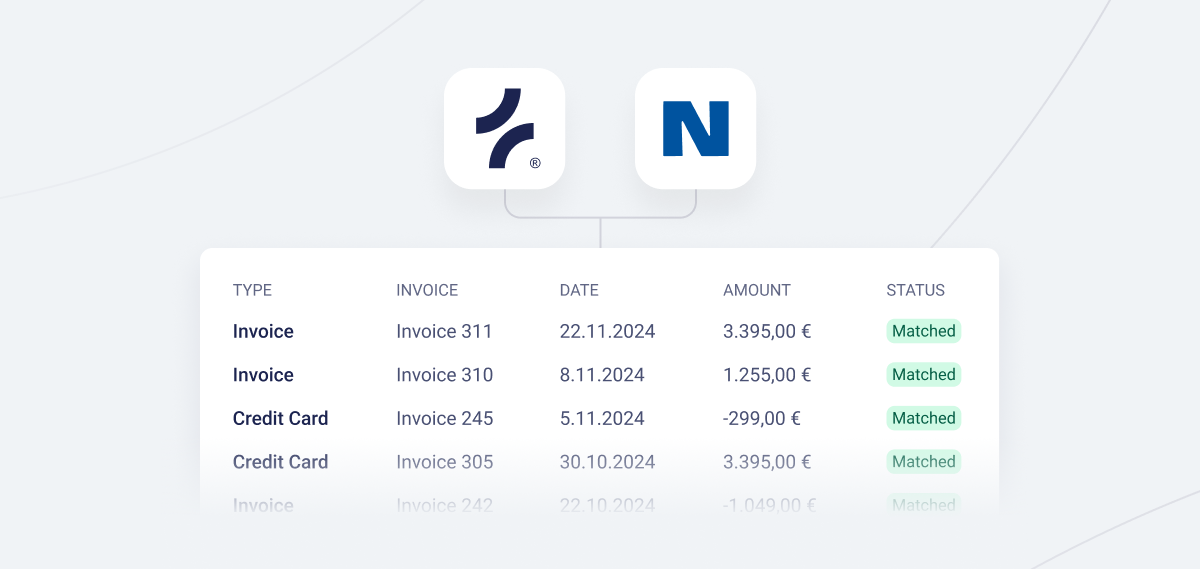

Fenerum's integration with Nykredit through Bank Connect helps your business automate bank reconciliation and streamline payment management. With this integration, your bank transactions are automatically matched with open invoices, saving time, reducing errors, and allowing you to focus on growing your business.

Benefits of the Nykredit integration

- Automated Bank Reconciliation: Incoming payments are automatically matched with open invoices in Fenerum, reducing manual work.

- Automated Payment Reminders: The system sends reminders to customers with overdue payments, improving your cash flow.

- Efficient Payment Monitoring: Automatically matches 95-99% of all payments.

- Daily Synchronization: The integration synchronizes bank transactions daily, ensuring your data is always up to date.

- Time Savings: By automating financial processes, you can focus resources on growth and development.

By integrating Nykredit with Fenerum, you can create a more efficient and accurate financial management system tailored to your business needs.

About Nykredit and Bank Connect

Nykredit is one of Denmark's leading financial institutions, offering solutions that meet the needs of both businesses and private customers. Through its partnership with Bank Connect, Nykredit provides a modern and secure platform that simplifies the integration of financial systems and daily banking operations.

The integration with Fenerum via Bank Connect delivers a reliable solution that automates and simplifies your payment management. It's an ideal solution for businesses looking to reduce the complexity of manual reconciliation.

Frequently askedquestions

How does the integration between Nykredit and Fenerum work?

Integration with Nykredit via Bank Connect allows Fenerum to monitor bank accounts for incoming payments and automatically match them with open invoices in the system. This ensures accuracy and saves time.

What are the benefits of the Nykredit integration for my business?

Automated bank reconciliation, payment reminders, and daily synchronization provide more efficient financial management and reduce the risk of errors.

How do I set up the Nykredit integration?

You can easily set up the integration by following the guide in our documentation here. The process requires minimal technical knowledge.

Is the integration updated daily?

Yes, the integration automatically synchronizes your transactions from Nykredit daily, ensuring your data is always up to date.

What is the success rate for payment matching?

The system automatically matches 95-99% of incoming payments, significantly reducing the need for manual intervention.

How do I get access to Bank Connect?

You can access Bank Connect by contacting Nykredit or visiting their official site here.